Esop value calculator

25 of the Options will vest on 31 December 207 Vest Date 3 The Options mature on 31 December 208 the Expiration Date Exercise Price of the Options is HKD 170. We come alongside your existing TPA to illustrate the long-term value of your employee stock.

Shares Outstanding Formula Calculator Examples With Excel Template

Companys post-money valuation after the last round.

. ESOP Calculator makes it simple to engage and motivate your employee-owners. An ESOP may not be a fit in every situation however all business owners can benefit from. As a qualified retirement plan an employee stock ownership.

As of 2022 we at the National Center for Employee Ownership NCEO estimate there are roughly 6500 employee. Years to project growth 1 to 50 Current annual salary Annual salary increases 0 to 10 Current. Use this calculator to help determine what your employee stock options may be worth assuming a steadily increasing company value.

Determining the value of a company for employee ownership purposes is both art and science. ESOPs also help in retaining employees. Use this calculator to estimate how much your plan may accumulate in the future.

In the case of a. ESOP Calculator makes engaging motivating and educating your employee-owners simple. Learn about employee stock ownership plans from the nations leading ESOP advisory firm.

Companies give ESOPs in parts there is a vesting schedule. The total of these expenses add backs is 125000 which when multiplied the 6X valuation variable equates to an additional 750000 of business valuation. The longer you are a participant in the ESOP the faster your balance grows.

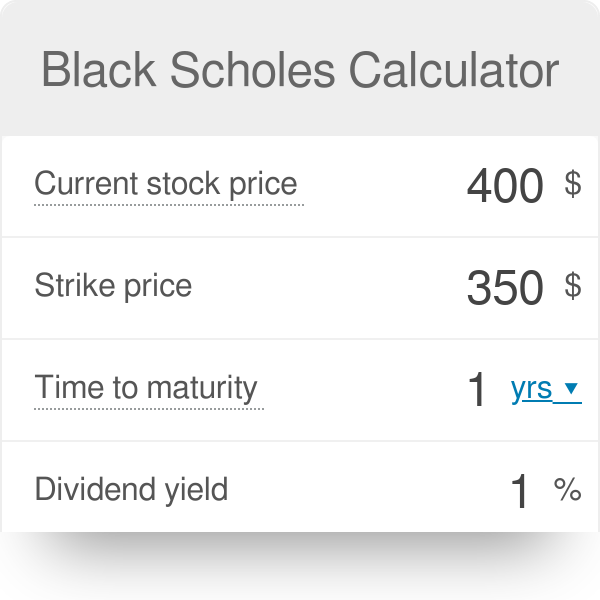

Enter current number of shares. Inputs for ESOP Valuation Exercise Price Usually this is a fixed number and forms part of the ESOP Scheme or Grant Letter In some cases companies choose to keep exercise. Years until option expiration date 0 to 20 Total number of.

Building value for our employees clients vendors and project teams since 1882. ESOP Calculator Calculating the value of ESOP for your next hire. The product is critical to initial ESOP transactions and to ongoing plan operations.

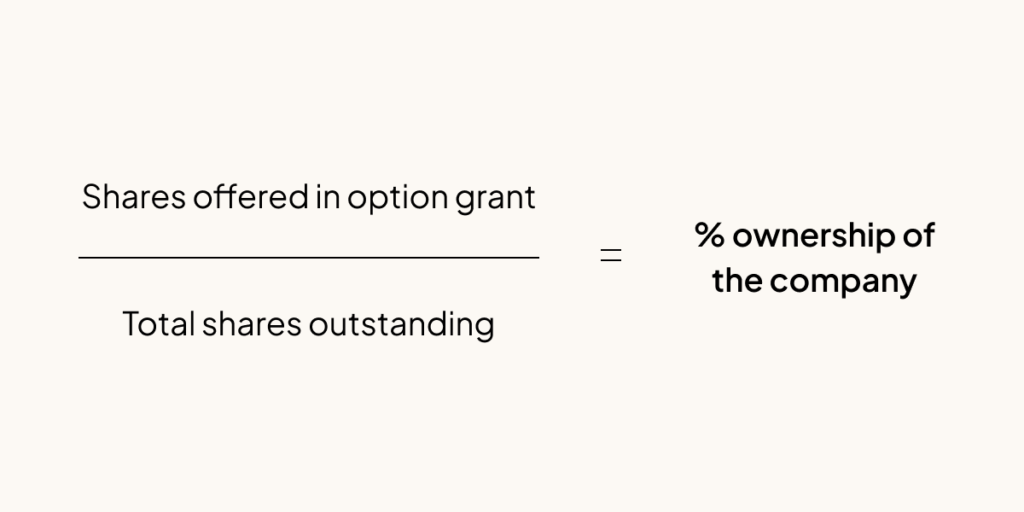

Learn about employee stock ownership plans from the nations leading ESOP advisory firm. This price is in most cases lower than the prevailing FMV Fair Market Value of the share. Use the calculator below to estimate the value of your startup equity based on different exit values.

Every year participants are allocated stock and the amount of stock in your account determines how. Our tool works alongside your existing TPA to solve your communication education and engagement. Projecting the exit value of a startup is a notoriously difficult task as the.

So today an employee may get 3000 shares which would be given in sets of 1000. Employee Stock Ownership Plan ESOP Facts Our ESOP Map of the US. Its needed to calculate and document any gain or loss in share value as well as the timing of that gain or loss for tax purposes.

Ad ESOP resources insights and primers from the ESOP experts at CSG Partners. Use this calculator to estimate how much your plan may accumulate in the future. Ad ESOP resources insights and primers from the ESOP experts at CSG Partners.

When it comes to calculating the tax on ESOPs many parameters are factored in the.

Black Scholes Calculator

926zhk5ypwr8qm

What Is Exercise Price In Esops And How Is It Calculated Trica Equity Blog

/dotdash_Final_Pre_Money_vs_Post_Money_Whats_the_Difference_Sep_2020-01-0a7184fe21204088baa6bfaa52db3217.jpg)

Pre Money Vs Post Money What S The Difference

Safe Calculator For The Y Combinator Post Money Safe

Stock Split Formula And Google Example Calculator Excel Template

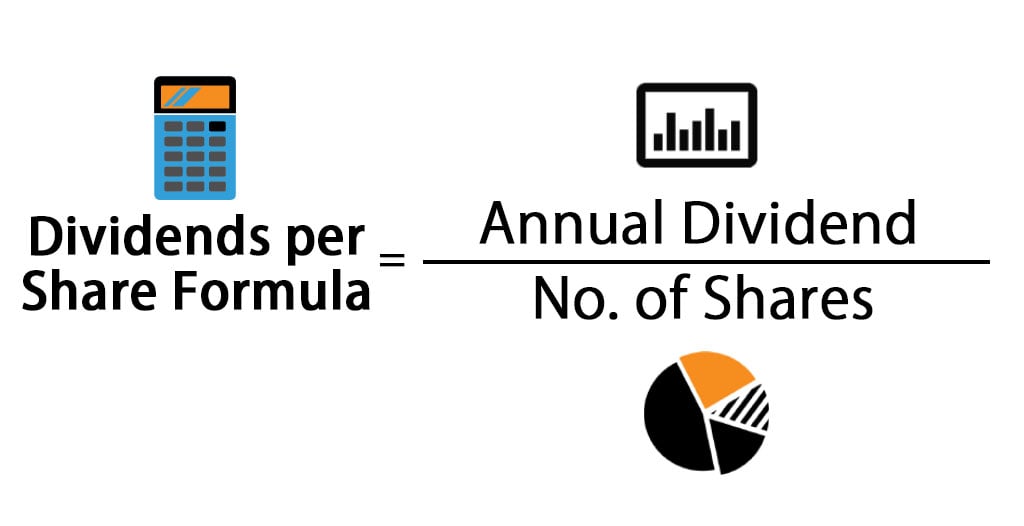

Dividends Per Share Formula Calculator Excel Template

Free Startup Equity Calculator Evaluate Your Equity Offer Carta

Employee Stock Option Valuation Software Excel Add In Hoadley

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-03-4346254c24b54206b3dda8692d4f0f7c.jpg)

What Is An Employee Stock Option Eso

Rate Of Return Formula Calculator Excel Template

Option Price Calculator American Or European Options

Startup Equity Value Calculator By Triplebyte

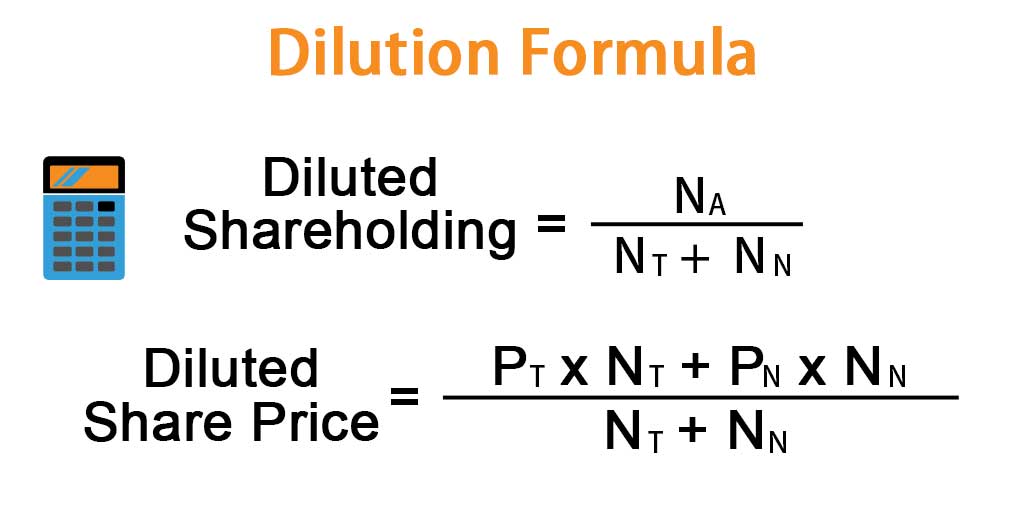

Dilution Formula Calculator Examples With Excel Template

Calculating Diluted Earnings Per Share

Free Startup Equity Calculator Evaluate Your Equity Offer Carta

:max_bytes(150000):strip_icc()/dotdash_Final_Pre_Money_vs_Post_Money_Whats_the_Difference_Sep_2020-01-0a7184fe21204088baa6bfaa52db3217.jpg)

Pre Money Vs Post Money What S The Difference